Hi, I'm Ha Ngoc Diep

I graduated from Foreign Trade University (FTU) specializing in International Economics. I finished the educational program with a 3.55/4 GPA.

I am interested in the post of Data Analyst. I learned about the job's nature, quantitative knowledge, and tools for analysis and forecasting such as Stata, Eviews, Python, and TSQL and create dashboard by Power BI.

I have done several data analysis projects using the above tools listed below.

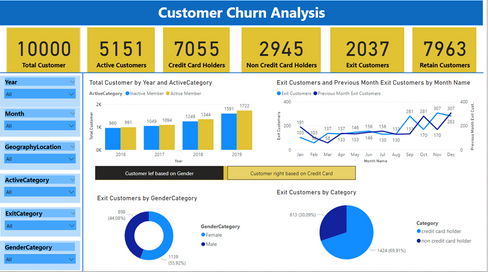

Interactive dashboard Power BI and Churn Modeling with Python about Banking Domain

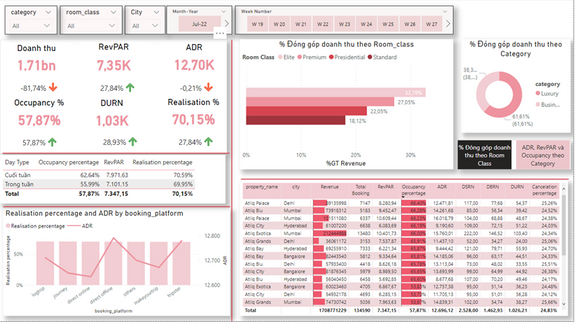

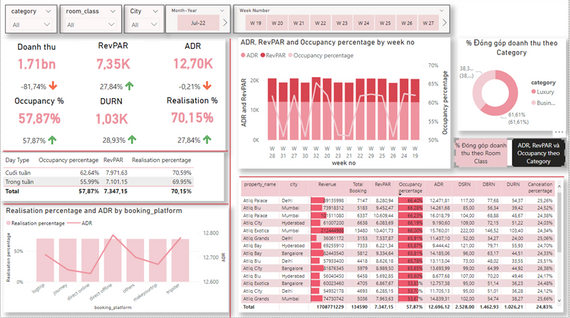

Interactive dashboard Power BI about Hospitality Domain

Zomato Dataset EDA by SQL Server

Analysis of factors affecting NPLs of Private Joint Stock Commercial banks in Vietnam

The data source is Kaggle. Links: https://www.kaggle.com/datasets/shrutimechlearn/churn-modelling

The project studies the relationship between data on individual customers, data on service usage at the bank and customer churn. Through data analysis and transformation via Python and visualization with Power BI, the project answers a number of important questions, for example:

- What is the age range with the highest exit rate?

- The country with the most customers in that age group

- Why is there a deep drop in the churn rate for the 7-year service user group?

- What does the number of survey votes for countries reflect on the results?

- Does gender affect the churn rate? When combined with other factors, how does it affect the churn rate?

- Does the amount in the account affect the churn rate?

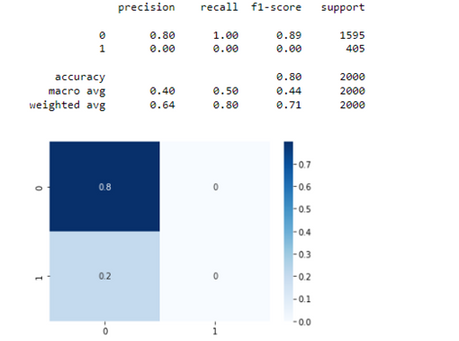

Through that, I remove outliers and build models to predict customer churn.

Dashboard

Indicators to evaluate model effectiveness

Data source is from Kaggle. Links: https://www.kaggle.com/datasets/ad043santhoshs/hospitality-domain

Dashboard shows revenue and business performance indicators: Total Succesful Booking, total successful bookings happened to the total rooms available(capacity), average ratings, the cancellaton, no show percentage, booking percenatge by Platform, Room class, ADR (Average Daily rate - average paid for rooms sold in a given time period),... and the change of those indicators week by week of the hotel system

Data source is from Kaggle. Links: https://www.kaggle.com/datasets/ad043santhoshs/hospitality-domain

I have written queries SQL Server to check the properties of each table and each data field, then clean the data and execute queries to find insights.

Through that, I have answered some important questions such as:

- The number of restaurants in each city, each country, the percentage of restaurants in each country

- What are the preferred culinary styles of restaurants?

- Currencies are commonly used at restaurants

- The popularity of services such as reservation of tables, online food delivery, ...

- Main price range of restaurants

- The min, max, avg,.. values of raiding, voting points. Add category field for rating

- Find the city and region with the number of restaurants in the top women

- The number of restaurants using pre-booking services, online food delivery, etc. in the crowded area of the Nth restaurant.

I also created some Scalar-valued functions and Stored Procedures so that they can be quickly reused in specific parameter cases

The project aims to study the factors affecting the bad debt of private joint stock commercial banks in Vietnam, the extent of their influence on the bad debt, and then propose solutions to limit bad debt. The project uses a quantitative research method with a model built from the model of Salas and Saurina (2002), Merkl and Stolz (2009), Messai and Jouini (2013) and Nguyen (2021) with the change of the independent variable. Set ROA to ROAE of the author to remove the variables of the period. The estimation methods used include: regression of least squares of error (POLS), random effects model (REM), and fixed effects model (FEM).

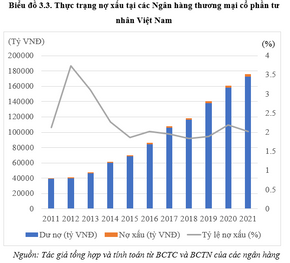

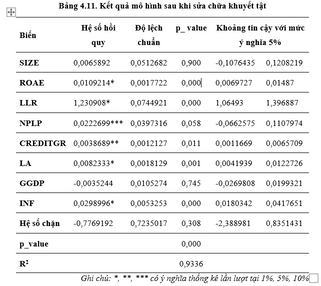

Research results show that bad debt of private joint stock commercial banks in Vietnam is affected by both macro factors and bank-specific factors. Business performance is expressed through ROAE index, credit risk provision through variable LLR, growth and credit risk are expressed through variables CREDITGR and LA respectively, bad debt in the past through variable. NPLP and inflation rate are statistically significant and have a positive effect on bad debt.

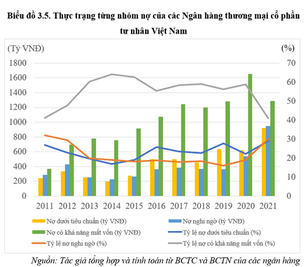

The project uses secondary data with GDP and inflation rate taken from World Bank and IMF, data of private joint stock commercial banks is collected from audited consolidated financial statements and annual report of 19 private joint stock commercial banks operating in the period 2011 – 2021.

The software used to analyze, process data and build models in this article is Stata 15 .

Some graphs about non performing loans and model results

Contact me

Phone Number

0377910676

Email Address

hangocdiepthtn@gmail.com

Linkedin